September 01, 2021

Retirement Savings Benchmarks By Age

Learn the popular age-based retirement savings benchmarks with this overview from Microsoft 365. See how much you should save for retirement.

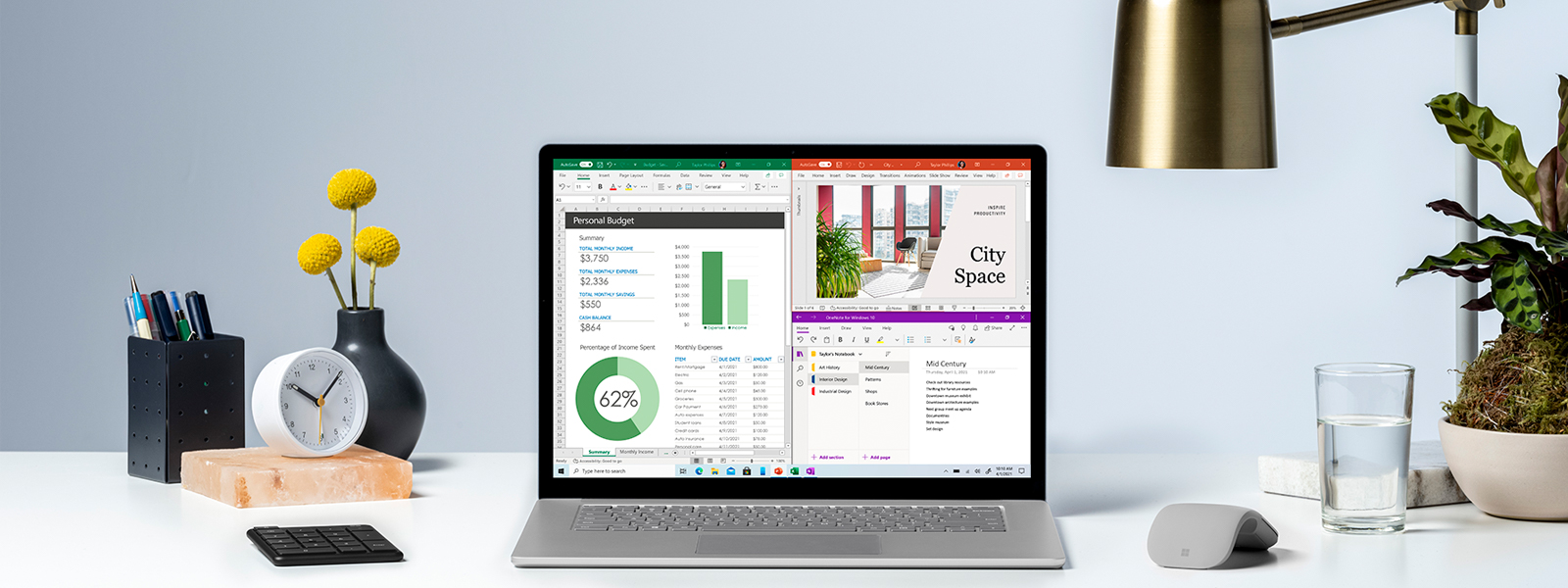

Learn moreIn the past, many people kept detailed ledgers to track income, expenses, investments, and other personal financial information. Now, however, it is easier than ever to keep track of your spending and plan for your financial future. No matter how much money you earn, you’ll benefit from a system to help you manage your personal expenses.

Start with this five-step plan and get a handle on your cash flow while you plan for your long-term financial goals.

You can’t change what you don’t see, so it is essential to put together a snapshot of your income, expenses, and priorities so that you can better manage personal finances. Use a personal money tracker to document your expenditures, even the minor ones like your daily coffee or occasional impulse purchases.

Use bank statements to take a look at both your daily and weekly spending, then zoom out to more long-term expenses like monthly bills, quarterly tax payments, annual charitable giving, professional dues, or subscription fees. Once you’ve gathered your receipts and statements, use a budget template to help you structure a personal financial plan.

After you’ve accounted for all of your spendings, it’s time to think about the habits you developed.

While you don’t need to make changes at this point, taking note of your habits and of how they affect your financial bottom line will become crucial as you start to set financial goals. Even if you have the money to support your current spending habits, you may find that you’d like to make changes for other reasons, including simplifying your routine or minimizing your acquisition of random “stuff.”

At this stage, put aside your budget and spend some time thinking about what you would like to accomplish over the next year. The next five years. The next ten years. You may want to:

Creating a list of short-term and long-term goals, then prioritizing those goals, can help you look back at your spending with fresh eyes. How much of your spending is getting you closer to the goals that you have in mind? This type of planning also helps motivate you as you develop new money habits.

Now is also a good time for you to consider working with a financial planner who can help you better understand your investment options and share strategies to help you accomplish your goals. In addition, your planner can help you create a realistic timeline so that you have a better sense of what to prioritize.

Once you have gathered your information, set goals, and consulted a professional about economic strategies, it’s time to make a financial plan. Again, you’ll want to formulate both short-term and long-term goals and understand how each one impacts the next.

For example, if one of your goals is to pay off debt, you’ll find that prioritizing that goal will free up money to make many of your other goals a reality. It’s also the time for you to revisit your spending habits and evaluate how cutting out mindless shopping, selling some assets, or even generating extra income can create more cash flow and get you to your goals faster.

Managing your personal expenses is not something that you do once. It is an ongoing commitment to tracking, planning, and prioritizing the various facets of your financial life. As you move forward, some of your goals may change. Some life events may cause you to shift your focus. A big promotion—or an unexpected layoff—can create major changes in your financial picture.

Take the opportunity to continue tracking, evaluating, and revising your financial plan. You’ll find that exercising more control over your personal expenses today can pay huge dividends in your quality of life tomorrow.